Sixty Degrees Ações Portugal

invest in portuguese companies

The SIXTY DEGREES AÇÕES PORTUGAL fund invests predominantly in companies listed on the Lisbon stock exchange (Euronext Lisbon), with an investment strategy based on three pillars:

-

Experienced management team

-

Minimum 85% invested in equities

-

Elegible for Investment Residency Authorizaton (ARI) in Portugal

Fund Performance

Sixty Degrees Ações Portugal

NAV per Share Performance - Share Class I (EUR) Data updated at 10/11/2025 - last valuation datePerformance and Returns – Share Class I

| 1st Trim. | 2nd Trim. | 3rd Trim. | 4th Trim. | Year | |

|---|---|---|---|---|---|

| 2021 | - | 5,0000€ | 1,05% 5,0526€ | 1,18% 5,1121€ | 2,24% |

| 2022 | 5,28% 5,3821€ | 3,88% 5,5909€ | -12,03% 4,9182€ | 6,62% 5,2439€ | 2,58% |

| 2023 | 6,09% 5,5630€ | 0,67% 5,6003€ | 5,57% 5,9121€ | 1,83% 6,0205€ | 14,81% |

| 2024 | 1,95% 6,1381€ | 5,60% 6,4816€ | 2,67% 6,6545€ | -1,75% 6,5378€ | 8,59% |

| 2025 | 10,26% 7,2084€ | 9,68% 7,9063€ | 3,85% 8,2105€ | 5,51% 8,6630€ | 32,51% |

| Performance since the fund launched at 10/09/2021 | 73,26% | ||||

Risk

The shaded area of the scale above highlights the fund's (share class I, R and T) risk classification based on the Summary Risk Indicator (ISR). The ISR indicator is a guideline on the level of risk of this product when compared to other products. It shows the likelihood that the product will suffer financial losses in the future due to market fluctuations.

| Low Risk | High Risk | |||||

|---|---|---|---|---|---|---|

| Potentially lower gains | Potentially higher gains | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

11.69% Value-at-Risk (VaR)

For a 99% confidence level, VaR (%) represents the maximum loss of the Fund's share classe I current portfolio within 30 days.14.39% Annualized volatility

The annualized volatility rate (%) is a risk indicator that measures the standard deviation of the Fund's share class I daily returns since its launch date.Notes

This information concerns the investment fund’s share class I managed by Sixty Degrees SGOIC, SA and does not dispense the reading of the respective constitutive documents: Fund prospectus and fundamental information for investors (IFI) are available at www.sixty-degrees.com without any burdens or charges.

The values refer to past recorded returns that do not consider income tax on redemptions (net of management fees and depositary), so they do not constitute any guarantee of future returns since the value of the investment may increase or decrease depending on the funds level of risk at that time. Sixty Degrees warns that, as a rule, greater profitability is associated with a higher level of risk. Profitability would only be obtained if the investment was made during the entire reference period. The value of 1 fund share may increase or decrease depending on the valuation of the assets that make up the fund holdings, which may imply loss of invested capital.

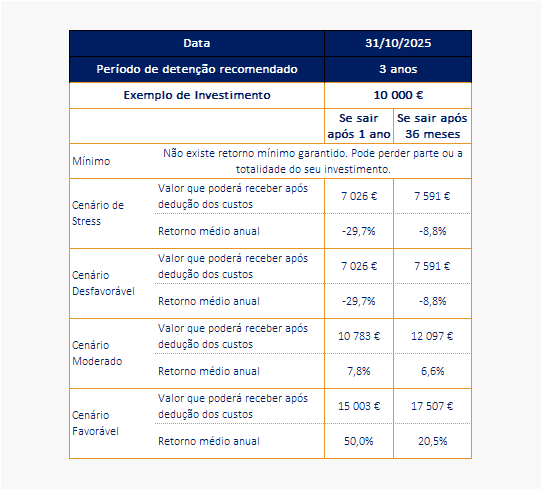

Cenários de Desempenho:

Este quadro mostra o montante que pode receber ao longo dos próximos 3 anos (período de detenção recomendado), em diferentes cenários, pressupondo que investe 10,000€.

Os cenários apresentados ilustram qual poderá ser o desempenho do seu investimento. Pode compará-los com os cenários de outros produtos. Os cenários apresentados são ilustrações baseadas em resultados do passado e em determinados pressupostos. Os mercados poderão evoluir de forma muito diferente no futuro. O cenário de stress mostra o que poderá receber numa situação extrema dos mercados e não inclui a situação em que o produto não está em condições de lhe pagar.

Os valores apresentados incluem todos os custos do próprio produto.

Segregated portfolio

The SIXTY DEGREES AÇÕES PORTUGAL is a Undertakings for Collective Investment in Transferable Securities (UCITS), whose assets are exclusively client’s property, segregated from the assets of both Sixty Degrees and the depositary bank.

Depositary Bank and the CMVM

Protecting the client’s assets is a priority for Sixty Degrees. We have selected a robust depositary totally independent from Sixty Degrees. The bank is responsible for keeping/recording, supervising and guaranteeing the fund’s assets in accordance with the law and the fund’s prospectus.

The SIXTY DEGREES AÇÕES PORTUGAL fund is authorised and supervised by the CMVM (Portuguese Securities Market Commission).